Zakat 101: Understanding and Practicing Islamic Charity

What is Zakat in Islam?

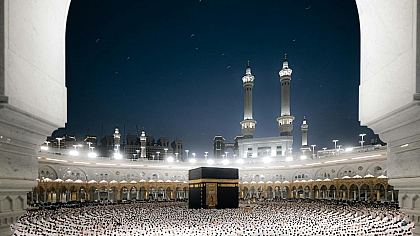

Zakat is one of the five most important rules in Islam. It is like a special tax on savings that Muslims give to people in need. Think of it as a way to clean your money and heart by sharing with others. It is not just a nice thing to do; it is a must-do for every Muslim who has enough money.

This act of giving helps make the world fairer. It takes a little bit from those who have a lot and gives it to those who have very little. This way, everyone can help each other and build a stronger, kinder community.

What You Need to Know About Zakat

- Zakat is a mandatory pillar of Islam, not a choice.

- It is 2.5% of the money and gold you have saved for one full year.

- You only pay if you have more than a specific amount (called the nisab).

- The Quran names eight types of people who can receive Zakat.

- Giving Zakat purifies your wealth and grows your spiritual rewards.

Why Do Muslims Give Zakat?

Muslims know and believe that everything we own actually belongs to Allah. We have just been looking after it for a while. Giving Zakat is a way of saying thank you to Allah for what we have. It is also a way to show we understand that we must share our good fortune.

The main job of Zakat is to fight poverty and help people who are struggling. It is a powerful system that makes sure everyone in the community is looked after. It helps:

- Feed hungry families.

- Help people who owe money.

- Support travelers who are stuck.

- Take care of orphans and widows.

When everyone gives a little, it creates a lot of good.

What the Quran and Prophet Muhammad (Sallallahu Alaihi Wasallam) Said

The Quran, the holy book of Islam, talks about Zakat many times. It tells us exactly who should get this help.

Prophet Muhammad (Sallallahu Alaihi Wasallam) also taught us about the huge benefits of giving charity.

Giving away a part of your money does not make you poorer. Instead, Allah brings blessings and more goodness into your life.

Who Can Receive Zakat?

You cannot give Zakat to just anyone. Allah named eight groups of people in the Quran. This makes sure the help goes to the right places.

| Group (in Arabic) | Who They Are |

|---|---|

| Al-Fuqara (The Poor) | People who have some money but not enough for their basic needs. |

| Al-Masakin (The Needy) | Those who have absolutely nothing. They are even worse off than the poor. |

| Al-'Amilina (Zakat Workers) | People whose job is to collect and give out Zakat funds. |

| Al-Mu'allafati (New Muslims) | Those who are new to Islam or those whose hearts we want to soften towards Islam. |

| Fi ar-Riqab (Slaves) | To free people who are slaves or captives. |

| Al-Gharimin (Debt-Ridden) | People who are in so much debt that they cannot pay it back. |

| Fi Sabilillah (Cause of Allah) | Those working in the way of Allah, like volunteers in community service. |

| Ibn as-Sabil (Travelers) | Travelers who are stranded and need money to get back home. |

How Do You Calculate Zakat?

Figuring out your Zakat is simple. You just need to follow a few easy steps.

Step 1: Check if you have reached the nisab. The nisab is the minimum amount of wealth you must have to pay Zakat. It is like the starting line.

The nisab value is equal to:

- 87.48 grams of gold or

- 612.36 grams of silver.

Most people use the silver value today because it is lower and helps more people give Zakat. You can find the current value on any good Islamic charity website.

Step 2: Add up your wealth. Look at all the money you have saved for one full year. This includes:

- Money in your bank accounts.

- Cash at home.

- The value of gold and silver jewelry you don't wear.

- The money people owe you that you expect to get back.

Step 3: Take away your debts. Subtract any money you owe to other people for bills or loans that need to be paid now.

Step 4: Calculate 2.5%. If the amount you have left is more than the nisab, you pay 2.5% of that total.

Example: You have $5,000 in savings that you have had for a year. You owe $500 in bills.

- $5,000 - $500 = $4,500.

- 2.5% of $4,500 is $112.50.

- Your Zakat would be $112.50.

Zakat vs. Other Types of Charity

Zakat is special, but it is not the only way to give. Islam has other beautiful forms of charity.

- Sadaqah: This is voluntary charity. It can be any amount, at any time. Even a smile or a kind word is a Sadaqah!

- Sadaqah Jariyah: This is a "continuous charity." It is a gift that keeps giving rewards even after you die. Examples are building a water well, planting a tree, or helping to build a school or hospital.

- Fitrana: This is a small charity given at the end of Ramadan before the Eid prayer. It helps poor people celebrate the Eid holiday.

- Qurbani: This is the sacrifice of an animal during Eid al-Adha. The meat is shared with family, friends, and most importantly, the poor.

Your Zakat Questions Answered

Q: Can I give Zakat to my family?

A: You cannot give it to your parents, grandparents, children, or grandchildren. You are already responsible for taking care of them. But you can give it to other relatives, like brothers, sisters, uncles, aunts, or cousins, if they are eligible.

Q: What if I forget to pay Zakat from previous years?

A: You should calculate what you missed and pay it back as soon as you can. It is still a duty you owe.

Q: Can I use my Zakat to build a mosque or school?

A: Usually, no. Zakat is for the eight categories of people listed. Building a mosque is a great deed, but it is paid for with Sadaqah or Lillah (voluntary donations), not Zakat funds.

Q: Do I pay Zakat on the house I live in or the car I drive?

A: No. You do not pay Zakat on your home, your car, or any furniture you use. You only pay on the extra wealth you are saving.

Q: How can I make sure my Zakat is used correctly?

A: Give to trusted local mosques or well-known Islamic relief organizations that have special Zakat funds. They have experts who make sure the money goes to the right people.

Your Next Step: Give with Confidence

Understanding Zakat is the first step. Now, it's time to act. Take some time this week to sit down and calculate what you have. It is not as hard as it seems. Remember, this small act of giving is a powerful tool. It feeds the hungry, protects the vulnerable, and purifies your own heart.

The Golden Rule

Zakat is due on gold, whether it is jewellery, coins, or bars, if you own it and its value meets a minimum threshold called the nisab.

Working out zakat for gold is a clear process. Here is a simple, step-by-step guide.

Step 1: Understand the Nisab (Minimum Threshold)

The nisab for gold is 87.48 grams.

-

To find its value in your currency, you must check the live market price of 24-carat (pure) gold per gram. You can find this on financial news websites or by searching "current gold price per gram" online.

-

Example for illustration: Let's assume a hypothetical price of $70 per gram for learning purposes.

-

Nisab Value = 87.48 grams x $70 = $6,123.60.

- This means if your total zakatable wealth (cash, gold, savings) is worth $6,123.60 or more, you must pay zakat.

-

Remember: You must use the real, current gold price on the day you calculate your zakat, not this example number.

Step 2: Weigh Your Gold

Gather all your pure gold items. This includes:

- Jewellery (22k, 21k, 18k)

- Gold coins or bars

- Any other gold you own

Important: You must work out the pure gold weight of each item.

- 24K gold is 100% pure. Its weight is its pure gold weight.

- 22K gold is 91.6% pure. You multiply the item's total weight by 0.916 to find the pure gold weight.

- 21K gold is 87.5% pure. Multiply the total weight by 0.875.

- 18K gold is 75% pure. Multiply the total weight by 0.75.

Example: You have a 22K gold bracelet that weighs 10 grams.

- Pure gold weight = 10 grams x 0.916 = 9.16 grams.

Do this for every gold item you have and add up all the pure gold weights.

Step 3: Calculate the Total Value of Your Gold

Multiply the total pure gold weight from Step 2 by the current price of 24K gold per gram.

Example:

- Your total pure gold weight = 100 grams.

- Current gold price = $70/gram.

- Total value of your gold = 100 grams x $70 = $7,000.

Step 4: Add All Your Other Zakatable Wealth

Zakat is not just on gold. You must add the value of your gold to your other zakatable assets, which include:

- Cash (in bank accounts or at home)

- Savings

- Money invested for personal gain

- The value of silver

- The value of goods you own for trade (e.g., a shopkeeper's stock)

Do NOT include items you use daily, like your house, car, or furniture.

Example:

- Value of your gold = $7,000

- Cash in your bank = $3,000

- Total Zakatable Wealth = $7,000 + $3,000 = $10,000

Step 5: Check if You Reach the Nisab

Now, check your Total Zakatable Wealth ($10,000) against the Nisab value you calculated in Step 1 ($6,123.60).

- Is your total wealth ($10,000) equal to or greater than the nisab ($6,123.60)? Yes.

- This means you are obligated to pay zakat.

Step 6: Calculate 2.5%

The zakat rate is 2.5% (which is 1/40th) of your total zakatable wealth.

Calculation:

- 2.5% of $10,000 = $250

- Or: $10,000 ÷ 40 = $250

Your zakat payment for the year would be $250.

Summary Table: The Zakat Calculation for Gold

| Step | Action | Example |

|---|---|---|

| 1 | Find the Nisab Value 87.48g x current gold price/gram |

87.48g x $70 = $6,123.60 |

| 2 | Weigh Your Gold Find the pure gold weight of all items. |

Total pure gold weight = 100g |

| 3 | Value Your Gold Pure gold weight x current gold price/gram. |

100g x $70 = $7,000 |

| 4 | Add Other Wealth Add cash, savings, etc., to the gold value. |

$7,000 (gold) + $3,000 (cash) = $10,000 |

| 5 | Check Nisab Is your total from Step 4 >= Step 1? |

$10,000 > $6,123.60 → Yes, pay zakat |

| 6 | Calculate 2.5% Total wealth ÷ 40. |

$10,000 ÷ 40 = $250 |

Frequently Asked Questions (FAQs) About Zakat on Gold

Q: What if my gold is less than 87.48 grams?

A: If the total pure weight of your gold is less than 87.48 grams, you do not pay zakat on it. However, you must still add its value to your cash and other assets. If that total combined wealth meets the nisab, you pay zakat on the entire amount.

Q: I have different karats (22k, 18k). How do I calculate?

A: Weigh each item separately. Then multiply each item's weight by its purity percentage (22k = 0.916, 18k = 0.75) to get its pure gold weight. Add all the pure gold weights together.

Q: When do I pay it?

A: You pay zakat once every lunar year from the date your wealth first reached the nisab. This is your "zakat anniversary."

Q: Is zakat due on the gold I wear every day?

A: Yes. There is no exemption for personal use when it comes to gold and silver. Zakat is obligatory on them whether they are worn, stored, or used.

Calculate your Zakat today. Your calculation can change someone's world.